Hybrid Program - General Information

Multiple carriers are utilized for hybrid program quotes, and funding options vary between aggregate only and level funded. All programs include a claims refund component in the event claims fall below the attachment point, with a 100% refund of all remaining funds. Internal “pooling limit” included as a means to reduce the net claims figure in order to produce a more competitive renewal rate.

Program Components

Available for groups of 25+ lives, though we try to focus on groups of 50+. “Sweet spot” is 75-150 lives.

Pooling limit – Varies based on group size

Contract options – Defaults to 12/21 (i.e. includes run-out liability), with option to do 12/12 w/ TLO

TLO Cost – Depends on the carrier. Some charge two and a half (2.5) months of premium & claims funding for six (6) months of TLO coverage, while others charge 35% of the aggregate factors for three (3) months of TLO coverage.

Bind Coverage

Individual applications required regardless of group size. However, this requirement can be waived based on receipt of claims data and group disclosure statement. Acceptable claims data may be detailed monthly premium vs. claims statement, or something as simple as the renewal worksheet provided by the current fully insured carrier.

Applications may be completed and signed within ninety (90) days of the effective date of coverage. The underwriter can accept other carrier/vendor forms including BUCA forms, FormFire, EasyApps, etc. If updated applications are not available, we can provide a carrier form for the employees to complete.

For claims data and disclosure statement, the underwriter will require the disclosure be signed no earlier than forty-five (45) days prior to the effective date of coverage. Additionally, the underwriter would like to see claims as close to the effective date as possible. This is sometimes impacted by the fully insured carriers’ rules re: data release.

Traditional Stop Loss - Specific & Aggregate

The stop loss contract provides protection for singular large claims as well as for total group claims.

The "specific" stop loss contract has the client assuming a specified amount of risk per member (ex. $20,000 per member), with any amount in excess of this amount reimbursed by the carrier.

The "aggregate" stop loss contract sets a minimum level of claims for the group called the attachment point. This is calculated based on the aggregate claim factors developed by the underwriter, and is typically equal to 125% of the groups expected claims. Any amount in excess of the attachment point will be reimbursed by the carrier.

Cash flow protection measures are built into the program on both the specific contract (specific advance) and aggregate contract (aggregate accommodation).

Client pays administrative fees and stop loss premiums based on employee head counts.

Client is billed on a weekly basis via funding requests for claims adjudicated by the TPA.

The pros of this approach are reduced fixed costs, full plan flexibility under ERISA, full data access via TPA, and improved customer service.

The cons of this approach are the ebbs and flows of the claims each month. The client needs to have the cash flow to absorb the inconsistent nature of the claims funding of this approach.

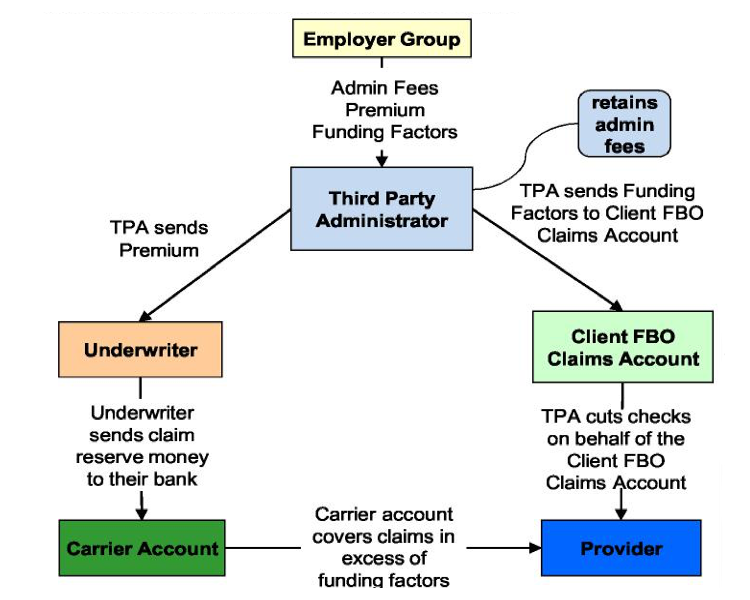

Hybrid Stop Loss - Aggregate Only

This program provides a capitated monthly rate that includes administrative fees, carrier premium, and claim funding factors.

Amounts remaining in the claims account at the end of the contract and returned to the client 100%.

The pros of this approach are consistent healthcare budget based on monthly enrolled lives, claims refund opportunity, full plan flexibility under ERISA, full data access via TPA, and improved customer service.

The cons of this approach are higher fixed costs.